Unlock the secrets to efficient payroll management and discover how automation can revolutionize your payroll processes in Denmark.

Understanding Payroll Requirements in Denmark

Navigating the payroll landscape in Denmark can be challenging due to its complex regulatory requirements. Companies must adhere to strict guidelines regarding employee compensation, tax withholdings, and social security contributions. Understanding these requirements is crucial to ensure compliance and avoid costly penalties.

Employers in Denmark are required to provide accurate payslips, deduct appropriate taxes, and report earnings to Danish tax authorities. Additionally, they must manage contributions to pension schemes and other social benefits. This comprehensive understanding is the foundation for efficient payroll management.

The Power of Automating Payslips, Tax Deductions, and Reporting

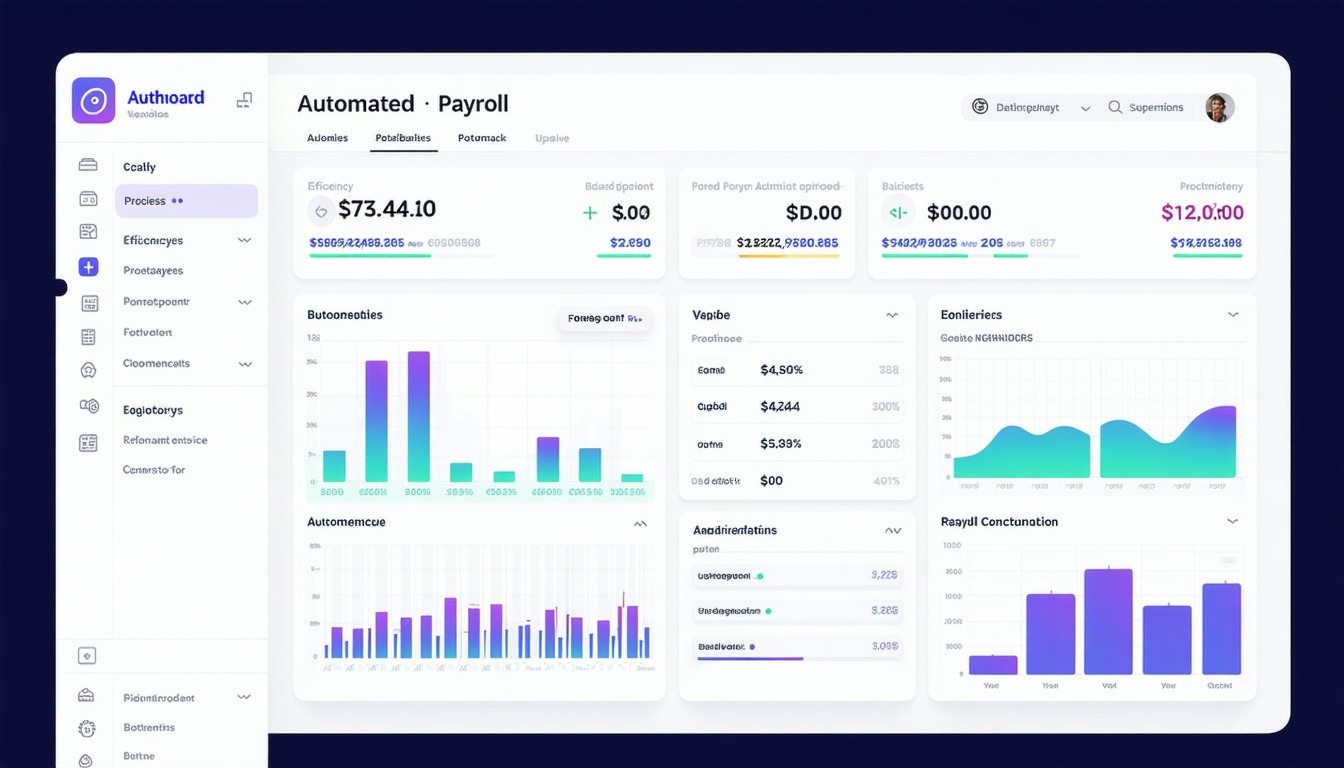

Automation in payroll processes can significantly enhance accuracy and efficiency. Automated systems can generate payslips, calculate tax deductions, and submit necessary reports to tax authorities with minimal human intervention. This reduces the risk of errors and ensures timely compliance with legal requirements.

Leveraging automated payroll solutions helps streamline repetitive tasks, allowing HR departments to focus on more strategic initiatives. Furthermore, automation provides real-time data and analytics, enabling better decision-making and financial planning.

Managing Freelancers, Sick Days, and Reimbursements with Ease

Handling diverse workforce needs, such as freelancers, sick days, and reimbursements, adds another layer of complexity to payroll management. Automated payroll systems can seamlessly integrate these variables, ensuring accurate and timely payments.

For freelancers, automated systems can manage varying rates and project-based payments efficiently. When it comes to managing sick days, automation ensures that leave balances are updated and payments are adjusted accordingly. Similarly, reimbursement processes for expenses can be automated, reducing administrative burden and speeding up the payment cycle.

How UniConomic Simplifies Your Payroll Process

UniConomic offers a comprehensive payroll solution designed to meet the specific needs of Danish companies. Our platform simplifies the entire payroll process, from generating payslips to managing tax deductions and reporting.

With UniConomic, companies can automate tedious payroll tasks, ensuring accuracy and compliance. Our solution is designed to handle complex payroll requirements, including managing freelancers, sick days, and reimbursements, all within a single, user-friendly interface.

Maximize Efficiency and Minimize Errors with Payroll Automation

Implementing payroll automation can transform your business operations by maximizing efficiency and minimizing errors. Automated systems reduce the manual workload on HR teams, allowing them to focus on strategic tasks that drive business growth.

Payroll automation also ensures data accuracy, reducing the risk of costly mistakes. By leveraging advanced algorithms and real-time data processing, companies can ensure compliance with Danish regulations, thereby avoiding penalties and enhancing overall operational efficiency.